Business Strategic development and aligment implementations

Competitive strategy means being different from competitors. This consists of developing a set of specific activities to support the strategic position. Defending this position, however, depends on the development of skills that competitors will find it difficult to emulate.

In management: “Strategy is a unified, broad and integrated plan … created to ensure the basic goals of the company are achieved.” It integrates the main goals, policies and action sequences of the organization into a cohesive whole.

The job of the strategist is to understand and cope with competition. Yet competition for profits goes beyond established industry rivals to include four other competitive forces as well: customers, suppliers, potential entrants, and substitute products.

The extended rivalry that results from all five forces defines an industry’s structure and shapes the nature of competitive interaction within an industry.

Understanding the competitive forces, and their underlying causes, reveals the roots of an industry’s current profitability.

The real question is how is the industry changing? There is a need for continuous and non-punctual analysis. That´s the point.

The point of industry analysis is not to declare the industry attractive or unattractive but to understand the underpinnings of competition and the root causes of profitability.

Those companies whose strategies have industry-transforming potential become far clearer. This deeper thinking about competition is a more powerful way to achieve genuine investment success than the financial projections and trend extrapolation that dominate today’s investment analysis.

If both executives and investors looked at competition this way, capital markets would be a far more effective force for company success and economic prosperity.

The conversation between investors and executives would focus on the structural, not the transient. Imagine the improvement in company performance—and in the economy as a whole—if all the energy expended in “pleasing the Street” were redirected toward the factors that create true economic value.

Business experts have a number of tools at hand. Here are other four frameworks that consultants and business analysts’ use, and that you might consider adding to your own set of tools.

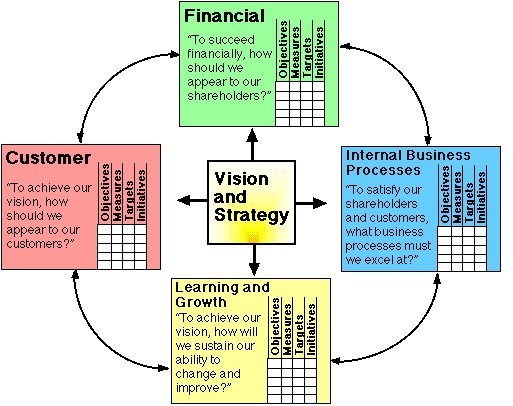

1. Balanced SCorecard (BSC)

The BSC, according to its creators, Kaplan & Norton (2004), is a strategic management model that communicates, aligns and monitors organizational strategy, translating vision and strategy into objectives and measures.

The scorecard is a comprehensive and quantitative set of objectives that can be measured over time. Common components include:

- Revenues

- Customer satisfaction metrics

- Earnings

- Market share

- Quality

2. BAIN & COMPANY

The methodology developed by Gottfredson & Schaubert (2008) presents the idea of achieving results from the definition of the starting point (diagnosis), a point of arrival (vision and objectives) and a path to be covered (plans to achieve the desired results. The beginning includes strengths, weaknesses, opportunities and threats among others. The arrival point should be ambitious and inspiring.

The strength of this methodology is the simplicity of its application, since it allows the definition of indicators and goals in a pragmatic way, which facilitates the monitoring.

3. Performance Prism

Researchers and administrators have become interested in integrated performance evaluation models, rather than using single measures. There was a growing need to answer the question, “How can we select a balanced and integrated set of performance measures?” As more people began to work on the subject, it became increasingly apparent that there was great value in deciding what to measure. The main reason is that this decision-making process forces managers to be clear in setting performance goals.

The model is based on three assumptions. The first, is the focus not only in two of the stakeholders – typically shareholders and clients – but in all interested parties. The second – strategies, processes and capabilities must be aligned and integrated in order to deliver value to all stakeholders. Third, organizations and their stakeholders have to recognize that their relationships are reciprocal, that is, stakeholders should contribute to the organization, as they have expectations for them.

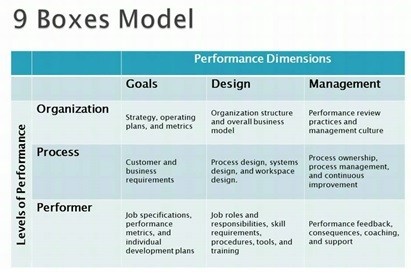

4. RUMMLER & BRACHE

The 9 performance variables model is based on a systemic structure that converts inputs into outputs for the organizations’ clients.

It is a map to direct the organization in the right direction, improvement of the operation and continuous improvement of the whole system.

The model guides the path of improvement to be followed. Another advantage is the possibility of seeing the interdependence of variables, which provides an integrated view of the key factors and avoids the realization of fragmented processes, projects and actions.