Value for Money

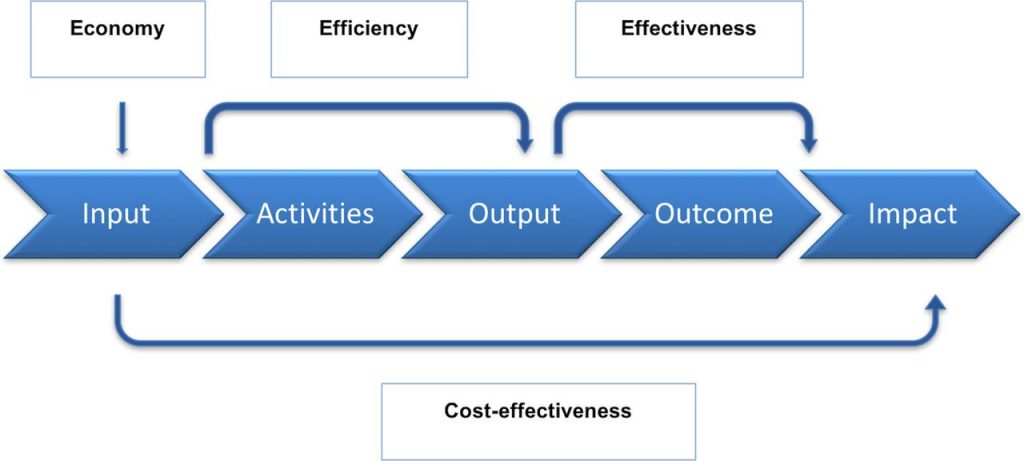

Value for money (VfM) has four basic meanings within the PPP development process.

Firstly, that there is an absolute benefit to a country of implementing projects through a PPP modality.

The fundamental objective of PPPs is to maximize efficiency and generate investment that is value for money.

PPP has the potential to offer better value for money through:

- Allocation of risk to the party that can manage it best, (Can the right type of risk be transferred; Is the size of risk large enough to serve as an incentive towards value for money; Are private partners willing to accept the risk to be transferred to them.)

- Performance based payments;

- Capturing private sector innovation, commercial and management expertise by involving the private sector more centrally in the provision of assets and services;

- Use of long-term contracts whereby bidders focus on the whole life cycle cost of projects and not just on the upfront capital costs. This can lead to more innovative designs with lower life-cycle costs and higher maintenance and operational standards;

- Better project delivery than the public sector; much reduced time and cost overruns;

- Increasing the tax revenue base of the country.

The second meaning; is that a project, undertaken through PPP, delivers a net benefit relative to a public procurement procedure for the same specific project i.e. the country receives a better deal through PPP than public procurement for any proposed project.

This is analyzed through a procedure for comparing public and PPP projects through use of the ‘Public Sector Comparator’ (PSC).

The VfM in relative terms, considered through the use of the PSC, is a micro economic financial tool that compares the project costs and revenues of the same project implemented under two different development scenarios i.e. by public or by PPP.

Within this relationship, the government specifies the quality and quantity of the service it requires from the private partner(s).The private partner may be tasked with the design, construction, financing, operation and management of a capital asset to deliver a service to the government or directly to end users.

A third issue is in the participation of insurers in the process avoiding the project with flaws. The presence of insurers will reduce the incentive to opportunistic behavior and will add another form of external verification.

The fourth: one of the characteristics of the PPP is to use Design-Build-Finance-Maintain-Operate (or variations of). It´s recommended to use “The Gold Book FIDIC”. It assumes a ‘green-field’ Design-Build-Operate project with a 30-year operation period – the related Guide contains guidelines on changes necessary to cover a ‘brown-field’ arrangement.

The public sector must observe the existence of a series of problems such as requests for economic and financial rebalancing, unsuccessful incentive designs, an increase of public expenses with payment of PPPs (higher costs), and a low efficiency and effectiveness as result.